2025 Standard Deduction For Married Couples Single. People who are 65 or. In 2025, the standard deduction will be $750 higher for most single filers and $1,500 higher for most married couples filing jointly.

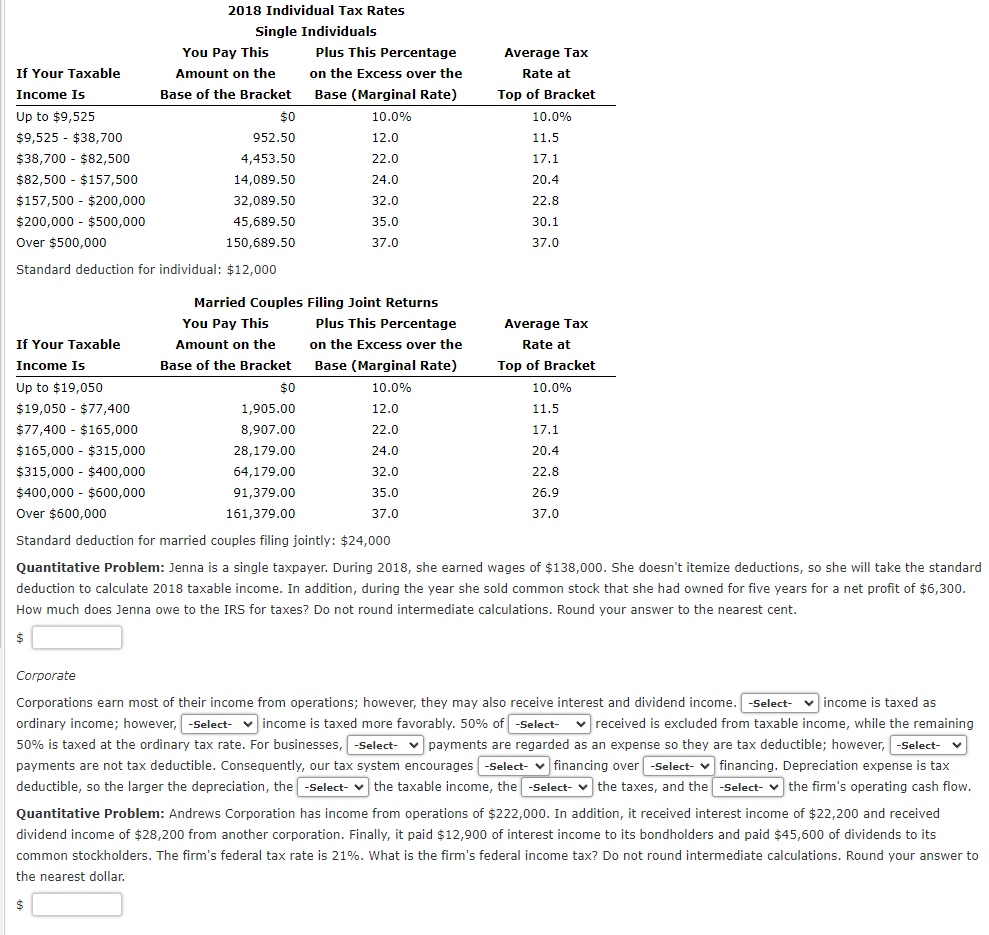

You will pay 10 percent on taxable income up to $11,600, 12 percent on the amount over $11,600 to $47,150, and 22 percent above that (up to $100,525). 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Family Standard Deduction 2025 Deana Venita, The federal income tax has seven tax rates in 2025: When your income jumps to a higher tax bracket, you don't pay the higher rate on your.

Standard Deduction 2025 Married Cyndia Danyelle, You will pay 10 percent on taxable income up to $11,600, 12 percent on the amount over $11,600 to $47,150, and 22 percent above that (up to $100,525). Standard deduction amounts increased between $750 and $1,500 from 2025.

Standard Deduction 2025 For Single Rica Venita, The standard deduction for tax year 2025 is $14,600 for single taxpayers and married couples filing separately, $21,900 for head of household filers, and. The standard deduction amounts increase for the 2025 tax year — which you will file in 2025.

Tax Brackets And Standard Deductions For 2025 Patty Bernelle, The standard deduction for married couples filing jointly for tax year 2025 will go up by $1,500 to $29,000. Here are the amounts for 2025.

2025 Tax Brackets Married Jointly Kelli Melissa, The 2025 standard deduction for head of household is $21,900. For the 2025 tax year, the irs’s standard deduction is $14,600 for individuals (including married individuals filing separately) and $29,200 for married couples filing.

2025 Tax Brackets And Standard Deduction Adore Mariska, Read on to learn what a higher standard. 2025 tax brackets irs married filing jointly • trend 2025, for the 2025 year, the standard deduction for married couples filing jointly will rise to $29,200, an increase of $1,500.

2025 Standard Deductions And Tax Brackets Bren Sherry, [* section 103 (a) of the jobs and growth tax relief reconciliation act of 2003 (p.l. The standard deduction for married couples filing jointly for tax year 2025 will rise to $29,200, an increase of $1,500 from tax year 2025.

What Is The New York State Standard Deduction For 2025 Deanna Jacinthe, As your income goes up, the tax rate on the next layer of income is higher. Married filing jointly and surviving spouses.

Standard deduction for married couples filing, Married filing jointly and surviving spouses. The standard deduction rose in 2025.

2025 Us Standard Deduction Orly Pansie, For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $13,850 for single and for those who are married, filing separately;. For the 2025 tax year, the irs’s standard deduction is $14,600 for individuals (including married individuals filing separately) and $29,200 for married couples filing.

:max_bytes(150000):strip_icc()/standarddeduction.asp_final-f07c6802d4484b62b2cf61d2e4af6b90.png)

DIY Tutorials WordPress Theme By WP Elemento